Finance | Experience Design | B2B | CX Strategy

Building Small Business Loyalty Through Design

Client

Commonwealth Bank

Timeline

6 months

Role

Design Lead

Overview & Challenge

I led a comprehensive project to develop a strategic vision for how Commonwealth Bank could better serve small businesses throughout their lifecycle. The challenge was to understand the intricate nature of small businesses, their needs, and how they evolve over time—crucial insight for the bank to tailor its services effectively in a competitive market.

Key Challenges

- Understanding the diverse and evolving needs of small businesses at different stages

- Gaining insight into emotional, behavioural, and operational changes throughout the business lifecycle

- Differentiating the bank's offerings in a crowded financial services market

- Creating practical frameworks that could guide service development

- Translating research insights into actionable strategic recommendations

- Balancing business profitability with genuine customer-centricity

My Approach & Contribution

I designed and led a robust research approach combining deep qualitative insights with quantitative validation, ensuring a holistic view of the small business landscape.

Key Activities

1. Conducted 70+ hours of qualitative research with 25 small businesses, exploring their habits, behaviours, attitudes, concerns, frustrations, and motivations

3. Hosted video snippet sessions to create empathy amongst the small business team and wider stakeholders

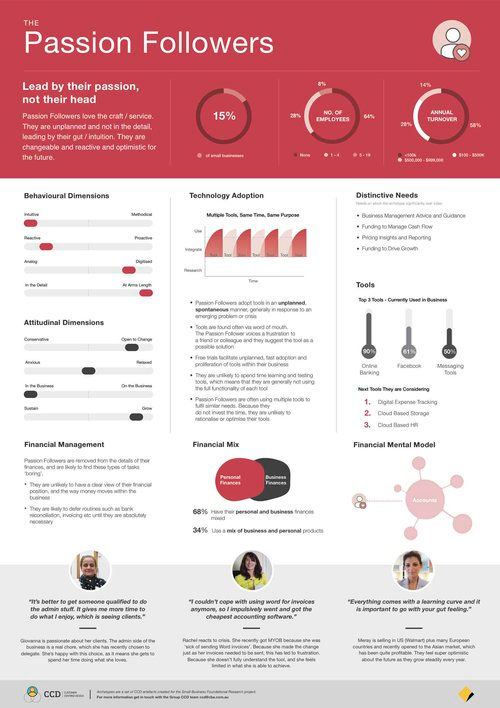

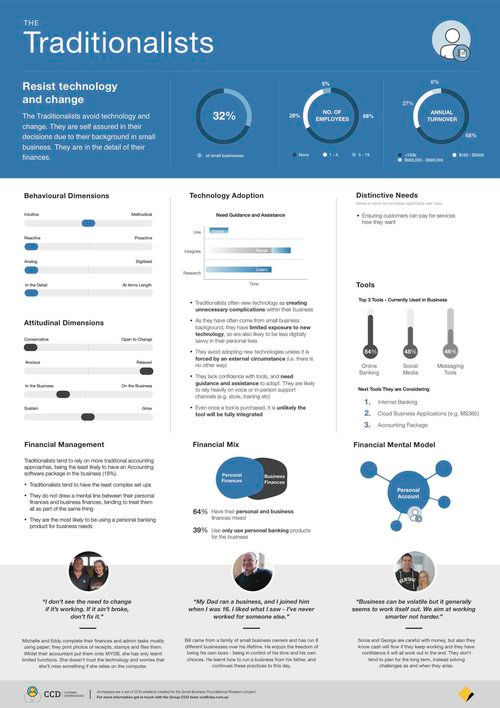

5. Developed five distinct personas based on behaviour and attitudes, offering a nuanced view of the small business landscape

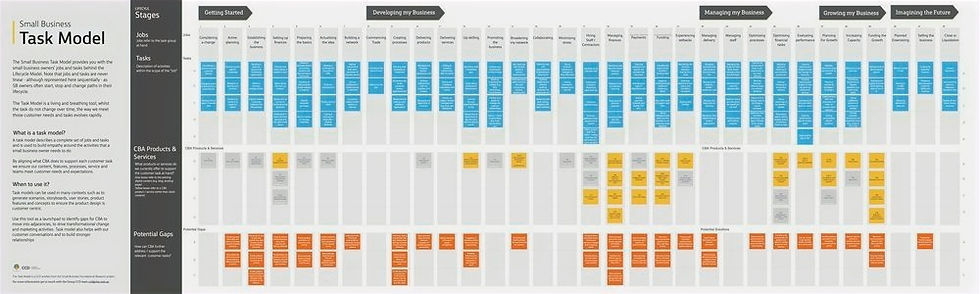

7. Designed a task model categorising and simplifying the tasks small business owners undertake

2. Deployed a market-representative survey with 873 respondents to validate and quantify our findings

4. Uncovered fundamental truths about small business owners that provided a foundation for understanding their motivations and challenges

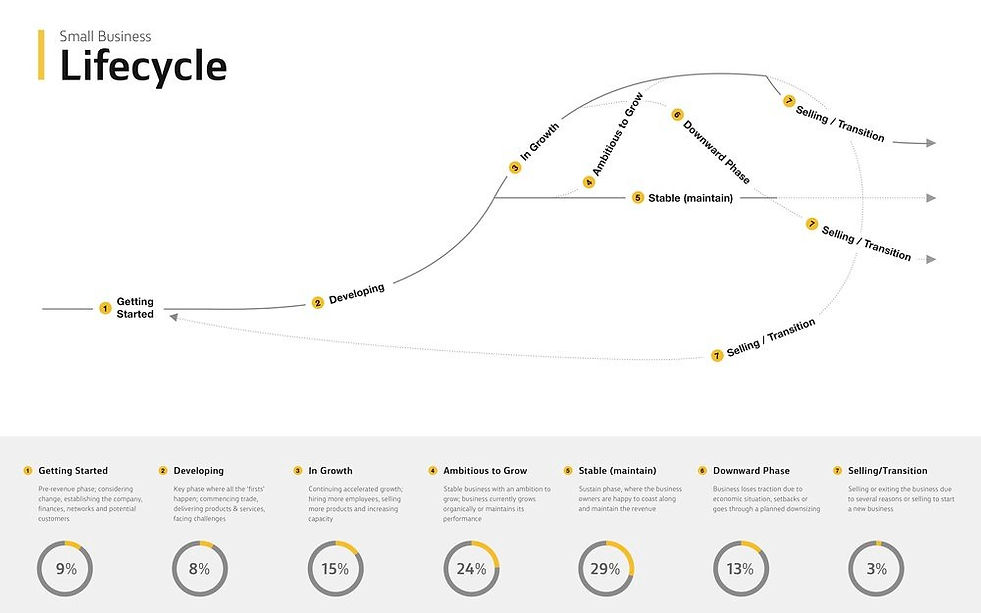

6. Created a comprehensive lifecycle model mapping the evolving needs and opportunities at each stage

What made this project unique was our focus on both the practical and emotional aspects of running a small business. We looked beyond transactional banking needs to understand hopes, fears, and motivations—giving the bank a much richer picture of their customers than they had previously held.

Results & Impact

01

Developed fundamental truths about small business owners, providing a foundation for understanding their motivations and challenges

03

Established a comprehensive lifecycle model mapping the evolving needs and opportunities at each stage

05

Organised 75 recommendations into 10 strategic opportunity areas for future development

02

Created five quantified personas based on behaviour and attitudes, offering a nuanced view of the small business landscape

04

Designed a task model that categorised and simplified the complex activities small business owners undertake

06

Provided the bank with a competitive advantage through deeper customer understanding than their rivals

Key Learnings

Business owners are people first, financial entities second. The real story of small businesses lives in their owners' passions and challenges - numbers like turnover only tell part of the picture.

Small businesses grow in unpredictable patterns, not smooth curves. They cycle through stability, growth, consolidation and sometimes pullback. Banking services need to flex with these natural rhythms instead of expecting steady progress.

The line between personal and business money is often blurry. Most small business owners don't separate their finances the way banks do. There's a real opportunity to create services that work with this reality rather than fighting against it.

Task Model

Task Model is pivotal. It categorizes and simplifies the tasks small business owners undertake, providing a clear framework for understanding their operational ecosystem. This model is essential as it allows CommBank to design services and solutions that align with the specific, often complex needs of small businesses at various stages of their lifecycle. By recognising and addressing these tasks, CommBank can offer more targeted, effective support, enhancing the overall customer experience for small business clients.